- 56 per cent say that moving to a different neighbourhood/community would be one of the top three sacrifices they would make

- 38 per cent would make the sacrifice of moving to a different city/province/region regardless of distance

- 38 per cent of Canadians define housing affordability as a home they can afford that meets their basic needs, and includes some liveability elements, such as green spaces and restaurants

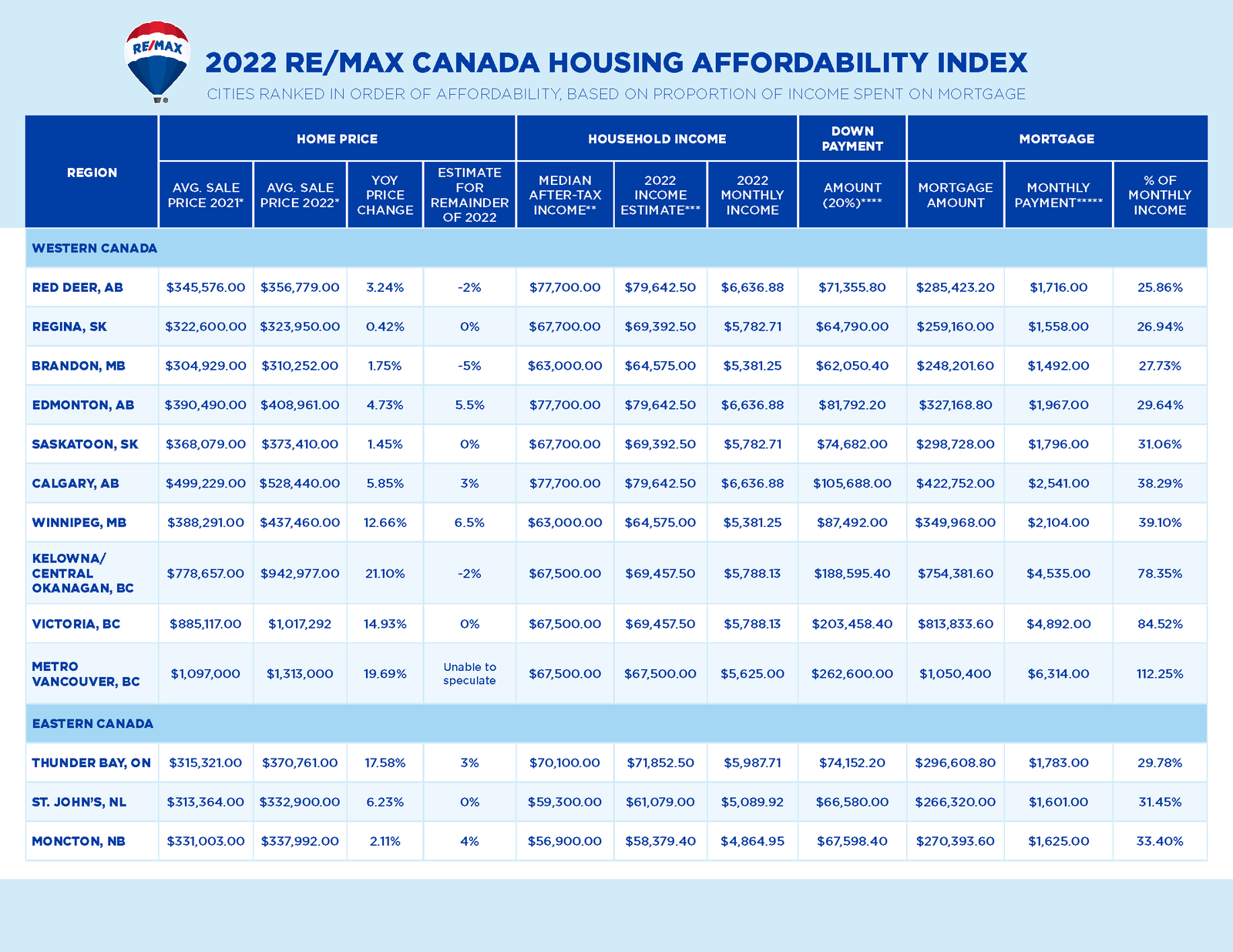

- Based on average residential selling price, Brandon, MB ranked as the most affordable market in 2022, replacing Winnipeg which was most affordable in RE/MAX Canada’s 2021 ranking. This is followed by Regina, SK (which remained on the list year-over-year), St. John’s, NL, Moncton, NB and Red Deer, AB

- Based on the share of income spent on mortgage payments, Red Deer, AB ranked as Canada’s most affordable housing market, with 25.86% of average monthly income spent on the average-priced home. This is followed by Regina, SK (26.94%) and Brandon, MB (27.73%) in Western Canada. Eastern Canada’s most affordable regions to buy a carry a mortgage include Thunder Bay, ON (29.78% of monthly income spent on mortgage), followed by St. John’s, NL (31.45%) and Moncton, NB (33.4%)